ACA’s 2022 Reduced Affordability Limit Should Cause Employer Action

Among its many provisions, the ACA says that Applicable Large Employers (ALEs)–those with 50 or more FTEs–must provide Minimum Essential Coverage (MEC) that meets Minimum Value (MV) standards and that is affordable to at least 95 percent of its full-time employees (those averaging 30 or more hours per week), or else the employer pays an excise tax penalty. “Affordable” is defined in the Act as the premium cost-share for employee-only coverage not exceeding 9.5 percent (as indexed) of an employee’s household income for the employer’s lowest-cost plan.

Since employers would not know an employee’s household income (e.g. second job, spousal income, investment income, etc.), the ACA regulations created three safe harbors for employers to utilize in place of the household income requirement. The Rate of Pay safe harbor is a method for proving ACA affordability that is based on an employee’s hourly rate or monthly salaried rate. The W-2 safe harbor involves the use of an employee’s W-2 Box 1, gross income. The Federal Poverty Line (FPL) safe harbor is a method for proving ACA affordability that is based on the published FPL for that year for a family of one.

Each year, the IRS announces the indexed amount of the 9.5 percent affordability standard for the upcoming year.

In 2021, the affordability index stood at 9.83 percent. In 2022, for only the second time since 2015 (when the ACA’s provisions of the employer mandate were first effective), the affordability index fell. For 2022, that percentage will be 9.61 percent. Since many employers utilize the FPL safe harbor, in 2022 that means that the cost to an eligible full-time employee for employee-only coverage of that employer’s lowest-cost health plan (regardless of the coverage level elected) cannot exceed $103.14 per month.

What does this mean for ALEs?

Action Steps

- Review your premium cost-sharing strategies for 2022. Assuming a traditional flat-dollar cost-sharing approach, taking your lowest-wage employee and determining if the monthly premium co-share for employee-only coverage exceeds 9.61 percent of their hourly or monthly salaried rate of pay; or 9.61 percent of that employee’s W-2 Box 1 income. [Note: be careful with this safe harbor since any salary reductions such as IRC Sections 125, 401(k), 403(b), or 457 reduce Box 1]; or exceed $103.14, the FPL safe harbor amount.

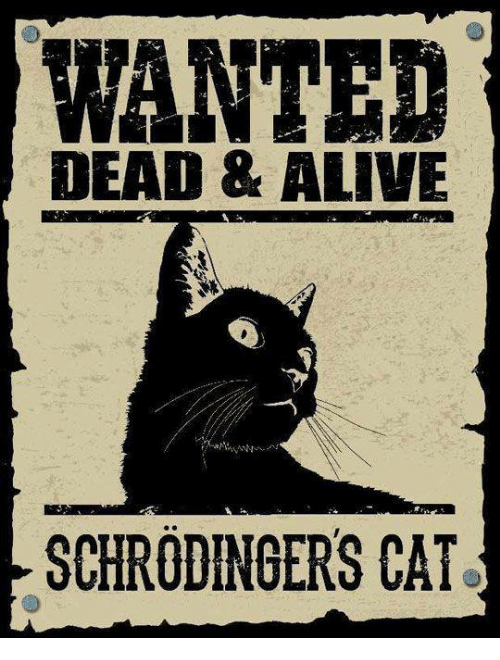

- Even though one of the IRS’ interpretations of the affordability standard makes little sense, be sure to calculate not just the dollar amount of the actual employee premium co-share but to add any medical opt-out offering (e.g. $100 per month if the employee is eligible for coverage but elects not to take it) to the total. Yes, it’s the Schrödinger’s Cat rule: an employee both has and doesn’t have health coverage at the same time.

- Lastly, be sure to add any wellness surcharges to your calculations. These too affect the affordability standard. And yes, if you offer wellness credits (the opposite side of the surcharge “coin”), you would exclude those from the final affordability calculation. Thus, on its face, Delta Airlines recent announcement of a $200 monthly surcharge for unvaccinated employees would automatically disqualify the use of the FPL safe harbor, even for vaccinated employees, since you would again meet Schrödinger’s Cat by having an employee both vaccinated and unvaccinated at the same time.

As we enter open enrollment time for calendar year health plans, if you are an ALE, do your homework on ensuring your lowest-cost health plan meets all three standards: Minimum Essential Coverage, Minimum Value, and Affordability.